The devastating hyperinflation in the post COVID world

COVID19 has had a devastating impact on the economies of the world. Many economically fragile nations got ruined post-COVID. The world is going through an uncertain passage where hyperinflation, depreciating currencies, wars between countries, internal protests/riots and debt traps are taking the center stage.

Here is a case study on how different countries of the world are faring in terms of inflation and currency depreciation in the post COVID19 world presented by our analyst David May.

First, we will see the list of the countries with inflation rates soaring to over three figures. The world-affected nations are

- Zimbabwe 257% (Jul/22)

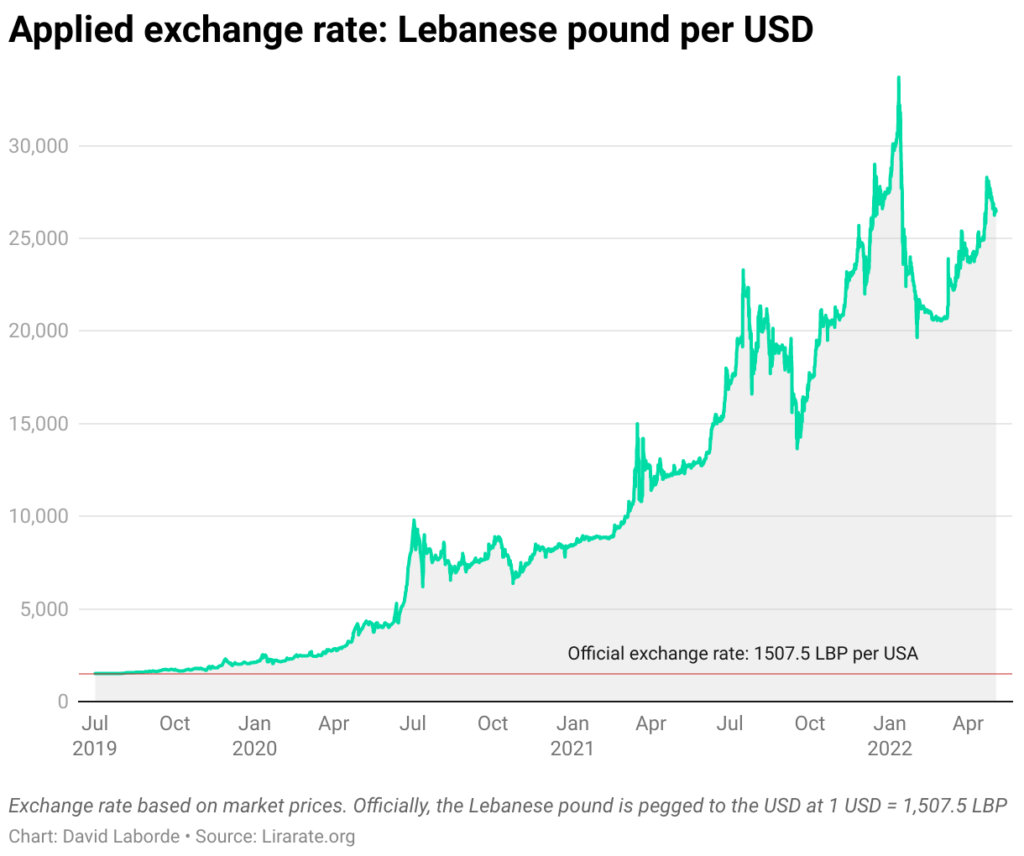

- Lebanon 210% (Jun/22)

- Sudan 149% (Jun/22)

- Syria 139% (Aug/21)

- Venezuela 137% (Jul/22)

Causes of the crisis: Zimbabwe is stifling under climbing international debt as it begins to pay the price for borrowing heavily from China for infrastructure projects at the tail end of Robert Mugabe’s regime. Ongoing giant infrastructure projects funded by Chinese financiers include the expansion of the Hwange Thermal Station with a loan of $1.2 billion, the upgrading of Robert Mugabe International Airport, and the construction of dams.

Zimbabwe owes $13.5billion to multilateral financial institutions, bilateral partners, and other creditors.

Due to extreme inflation in the country post COVID19 pandemic, 61% of people in Lebanon reported challenges in accessing food and other basic needs at the end of 2021 according to the World Food Program (WFP).

Causes of the crisis:

One of the worst Debt to GDP ratios in the world and huge depreciation in the currency.

- The refugee crisis of over 1.5 million refugees from the Syrian civil war.

- Collapse of the Ponzi scheme led to the steady decline of the Lebanese lira.

- Devastating double blast at the port of Beirut on 4th August, 2020: In addition to killing more than 200 and injuring 7,000, the explosion ruined businesses and the port infrastructure, including giant wheat silos.

- Dependence on Ukraine for the import of wheat in the country.

Sudan had the worst impact of COVID19 and geopolitical tensions since 2020.

- Sudan’s inflation rate for 2019 was 50.99%.

- For 2020 it was 150.32%, a 99.33% increase from 2019.

- For 2021 it galloped to 382.82%, a massive 232.49% increase from 2020.

- But now in 2022, it is coming down but still is in three digits.

Causes of the crisis:

Military Coup and political instability has resulted in protests and economic instability in Sudan.

- Furthermore, Sudan’s government pursued a policy of economic liberalization that has enabled a tiny group of traders, influential people, and capitalists to regulate the majority of Sudanese commercial activity. As a result, monopolistic practices have spread in primary commodities like sugar and building materials, and a significant proportion of the import and export sectors.

- All this coupled with the Ukraine-Russia war leading to extreme food insecurity has led to extreme inflation in Sudan.

- Sudan has undertaken a huge debt from France, Austria, the United States, Kuwait, Saudi Arabia, and China along with the International Monetary Fund (IMF).

Reasons : Historical civil wars, the ISIS crisis, drought in North-Eastern Syria and increase in global commodity prices as a result of the Russia-Ukraine war has led to hyperinflation in Syria.

Syria is seeking debts from China out of misery to rebound from the steady and sharp plunge in its economy since 2011, the year the civil war amplified. However, joining hands with China will come with the risk of a vicious #DebtTrap that countries like Srilanka, Zimbabwe, Djbouti, and Pakistan are already suffering from.

Causes of the crisis: The crisis in Venezuela is an ongoing socioeconomic and political crisis that began in Venezuela during the presidency of Hugo Chávez and worsened during Nicolás Maduro’s presidency. It has been marked by hyperinflation, escalating starvation, disease, crime, and mortality rates, resulting in massive emigration from the country.

- More than 6 million refugees, asylum-seekers, and migrants from Venezuela have left the country seeking food, work, and a better life.

- COVID19 however, exacerbated the crisis in Venezuela. Venezuelan migrants who returned to the homeland after losing their jobs abroad in the wake of the pandemic have been unable to earn wages back home. Deficiencies of fuel, electricity and clean water have flared riots and left many migrants with no option but to flee again.

- The country was once believed to be the most affluent in Latin America, thanks to holding the most extensive petroleum reserves in the globe. But more than a decade of plunging oil revenue and flawed administration led to the descent of the national economy, and the government has not been able to provide sufficient social services.

The next group of countries whose economies are facing the heat due to the geopolitical crisis, food insecurity, debt traps, and hyperinflation in the post-COVID world are as follows

- Turkey 79.6% (Jul/22)

- Argentina 71% (Jul/22)

- Sri Lanka 60.8% (Jul/22)

- Suriname 55.6% (May/22)

- Iran 54% (Jul/22)

The currency of Turkey has lost more than 20% of its value against the US dollar since the start of 2022. The inflation rate which was just over 8% in October 2019, reached 80% in July 2022. Other than global issues concerning all the nations, following the causes of the crisis in Turkey:

- President Recep Tayyip Erdogan’s flawed monetary policy. (like decreasing the cost of borrowing to increase the demand instead of cooling it down)

- Irrational hikes in the minimum wages. (A massive hike of over 50%)

- An all-time high External Debt reached $451.2 billion in March 2022, compared with $442.5 billion in the previous quarter.

A woman displays her electricity bill during a protest against high energy prices in Turkey.

Protests have erupted in various parts of Turkey to protest against the rising prices.

Over hundred thousand people participated in a march for employment and fair wages and against hunger and poverty on the Plaza de Mayo in the center of Buenos Aires organized by the workers movement Unidad Piquetera (Picketers Union), as part of widespread protests across Argentina.

After the year 2020, inflation galloped past 70%. Analysts surveyed by Argentina’s central bank raised their inflation estimate for 2022 to 90.2%. The primary reasons were expansionary monetary policy, populist policies, and the 2018 Argentine monetary crisis which led to a severe devaluation of the Argentine peso.

In February, Argentina became the latest member of China’s controversial Belt and Road Initiative (BRI). China is luring it for investments and heavy loans to come out of the crisis. Thus Argentina needs to vary the intentions of China to safeguard its economy in the long run.

The world has witnessed the catastrophe of the economy of Sri Lanka. The primary reasons behind the mega fall of the beautiful island nation were:

- Corruption & Nepotism by the Rajapakshas

- Useless Infrastructure projects by the Chinese Money

- Ruined Tourism Sector (post COVID lockdowns)

- Food and Fuel shortages

- Colombo Port City Project

- Debt Trap

Huge Debt with vicious loan repayment terms led to a Chinese takeover of Hambantota Port for 99 years.

On the left is an image of the protests that erupted in Sri Lanka against the Hambantota takeover.

Other nations that might slip into a deep crisis in the near future are:

Malawi (24.6%), Pakistan (24.9%), Laos (25.62%), Cuba (26.16%), Haiti (27.8%), Sierra Leone (28%), Ghana(31.7%), Ethiopia (33.5%) and Moldova (33.55%)

Finally, let us look at the performance of the five biggest economies of the world. Following is a brief analysis of the same:

The annual inflation rate in the US slowed more than expected to 8.5% in July of 2022 from an over 40-year high of 9.1% hit in June.

The US is lagging behind to control the energy inflation (32.93% as of July 2022) mainly due to a big slowdown in gasoline costs, fuel oil, and natural gas while electricity prices accelerated (15.2%, the most since February 2006)

The American economy shrank an annualized 0.9% in second quarter of 2022, after a 1.6% drop in the first quarter. It is a serious cause of concern for the US. According to Economic Experts, the US is technically entering a “phase of recession”.

Despite the strict COVID19 lockdowns and protests in various parts of the country, China has been able to control inflation vis-à-vis other countries.

China’s annual inflation rate climbed to 2.7% in July 2022 from 2.5% in June. It is the sharpest rise in consumer prices since July 2020, mainly due to a surge in food costs, with the price of pork bouncing back sharply after a cut in production capacity and a strong recovery in demand.

The Chinese economy advanced just 0.4% YoY in the second quarter of 2022, slowing sharply from a 4.8% growth in the first quarter. The latest figure was the slowest pace of expansion since a contraction in 2020 when the initial COVID19 outbreak emerged in Wuhan (China).

The annual inflation rate in Japan increased to 2.6% in July 2022 from 2.4% in June. It was the 11th consecutive month of an upsurge in consumer prices and the fastest pace since April 2014, amid surging fuel and food costs following the Ukraine-Russia war as well as a sharply weakening yen.

Japan’s economy grew an annualized 2.2% in the second quarter of 2022, as robust private consumption provided a boost to the country’s long-delayed recovery from the COVID-19 pandemic.

The annual inflation rate in Germany was confirmed at 7.5% in July of 2022, slowing for the second straight month, from 7.6% in June, as the relief package and the fuel discount have had a slight downward consequence on the prevailing inflation rate since June. The figure remained at roughly a forty-year high predominantly due to higher energy prices.

In the first quarter, the German economy grew by a revised 0.8%, much higher than initial estimates of 0.2%. However, the recent trend of the second quarter is a cause of concern for the German economy. It slowed down in the second quarter of 2022 compared to the previous three months, and missed market forecasts of a 0.1% rise sending a shockwave all across Europe.

The annual inflation rate in India hemmed lower to a five-month low of 6.71% in July of 2022 from 7.01% in June. A downshift was seen in price of food (6.75% vs 7.56%); conveyance & communication (5.55% vs 6.9%) and health (5.45% vs 5.47%) in June, while inflation increased for fuel and light (11.8% vs 10.39%).

The Indian economy expanded to a remarkable 5.4% and 4.1% in the previous two quarters and is projected to grow to over 8% in the next. The GDP growth rate was 8.7% in the last fiscal year. India’s Gross Domestic Product (GDP) grew at a humongous 13.5% in the first quarter of 2022-23, the fastest pace in four quarters, with the Gross Value Added (GVA) in the economy rising by 12.7%.

India witnessed a fall in the currency compared to the USD, but it stayed afloat and below 80INR for 1$ in the year 2022.

Most countries in the world are in a state of despair. Hyperinflation in the post-COVID world has impacted the lives of a large number of people. Flawed monetary policies, wars, internal protests/riots, and debt traps have led to the downfall of economies. Therefore the world needs rejuvenation to return lives to normalcy.

David May compiled and curated this report

David May(Economic Expert – Ij-reportika)

Sources:

- http://www.veritaszim.net/

- https://tradingeconomics.com/

- https://www.ifpri.org/

- https://www.economist.com/

- https://www.reuters.com/

- https://www.reuters.com/article/sudan-economy-debt-idUSL5N2N30NB

- https://edition.cnn.com/

- https://www.tcmb.gov.tr/wps/wcm/connect/EN/TCMB+EN/Main+Menu/Statistics/Inflation+Data/

- https://www.mapchart.net/world.html