Embarking on a journey into the shadows, our investigative report delves deep into the intricate web of Chinese Loan Applications, revealing a disturbing narrative that extends beyond borders. Titled “The Dark Side of Chinese Loan Applications,” this exposé uncovers the unsettling realities concealed beneath the seemingly innocuous facade of digital lending.

From countries in South Asia, and South East Asia to the intricate landscapes of Africa, our exploration unveils stories of individuals caught in a relentless cycle of exploitation, harassment, and economic upheaval. As we traverse through the underbelly of this pervasive issue, the report sheds light on the personal ordeals and systemic threats that mark the dark side of Chinese loan apps. Join us on this journey to unravel the hidden dimensions and consequences of the ever-expanding influence of these applications.

Download the Complete Report: Link

Exploiting Personal Data for Extortion and Illicit Profits

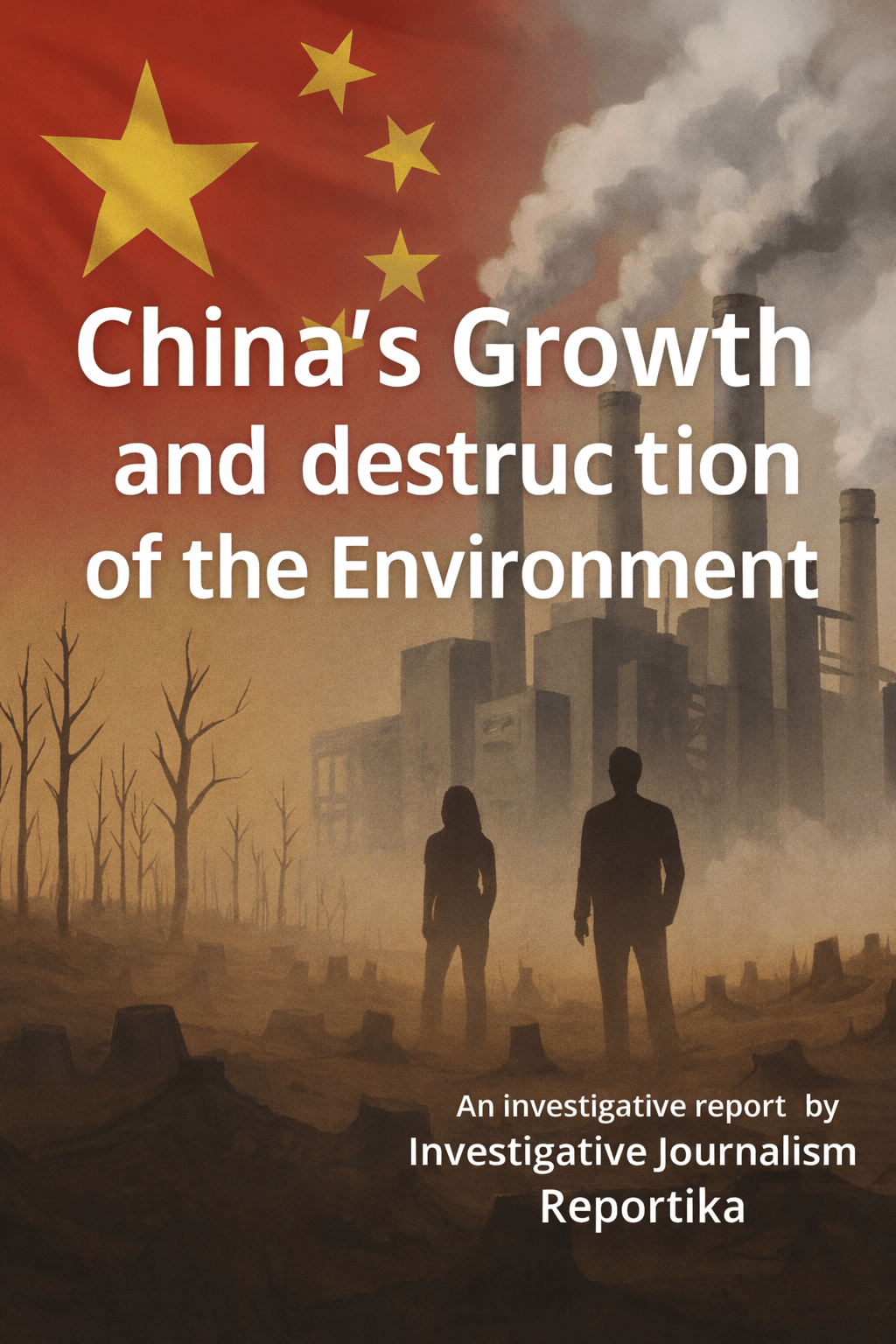

In our investigation, a stark revelation emerged regarding the intrusive nature of Chinese Loan Applications, which not only exploit financial vulnerabilities but also brazenly invade personal privacy. These applications, under the guise of loan processing, surreptitiously access sensitive data, including contact books and gallery permissions. Shockingly, our findings indicate that this personal information becomes a potent tool for malicious purposes.

In instances involving female victims, loan providers resort to despicable acts of blackmail, threatening to disseminate morphed images to their contacts. Beyond such heinous practices, our investigation indicates a disturbing trend – the sale of this stolen personal data on online platforms and the dark web. The consequences are far-reaching, ranging from the inundation of contacts with various advertisements to the orchestration of targeted advertising campaigns. This blatant disregard for individuals’ privacy underscores the insidious nature of these applications and amplifies the urgent need for regulatory intervention.

Complete Report: Link

Tactics Employed by Chinese Loan Apps “Agents”

- Relentless Calls from Loan Recovery Agents: These agents, oblivious to decency, persistently hound borrowers throughout the day, indifferent to appropriate timing and even encroaching into the late hours of the night. The incessant calls become a source of perpetual worry and disruption for the already distressed borrower.

- Verbal Assault and Menacing Language: The lenders stoop to the lowest depths by employing abusive language and delivering explicit threats during their relentless calls. The borrower is subjected to a barrage of intimidating messages, including threats of physical harm to themselves or their loved ones if they fail to meet the stringent repayment terms.

- Exploitative Blackmail Tactics: Resorting to blackmail, lenders exploit the vulnerability of borrowers by threatening to divulge sensitive personal information or initiate legal action against them.

- Intrusive Harassment of Contacts: Loan providers, armed with access to the borrower’s contacts, extend their harassment to friends, family, and employers. The borrower, now subjected to humiliation on multiple fronts, grapples with the profound distress caused by this intrusive violation of privacy.

- Menacing Messages Delivered Across Platforms: The lenders escalate their torment by bombarding the borrower’s phone and email with threatening messages. In an insidious move, they extend their reach to the borrower’s social media accounts, posting menacing messages that further intensify the psychological toll on the victim.

Unnecessary Permissions to Harass Users

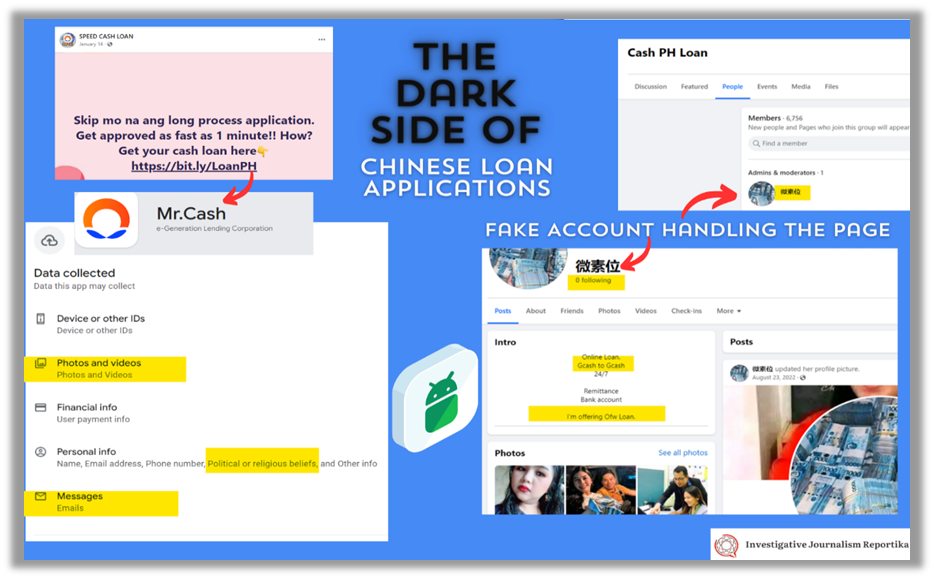

Our investigation has revealed that certain loan applications engage in concerning practices where unnecessary permissions are requested from users. According to our investigation, beyond the legitimate requirements for loan processing, these applications exploit their users by seeking access to sensitive information such as personal contacts, pictures, and location data. This unwarranted intrusion not only poses a serious breach of privacy but also creates a platform for harassment, tracking, and intimidation.

A compelling case study delves into the operations of the widely-used loan application in the Philippines, Atome PH. Notably, two-thirds of the individuals managing its Facebook Page hail from China and Taiwan. However, user experiences with the application reveal a troubling pattern—many have voiced concerns about the app’s abrasive treatment during repayment, subpar customer support, and the imposition of undisclosed charges.

In another case study examining the Mr.Cash application, our investigation has uncovered alarming findings that highlight a troubling trend of predatory lending practices and potential privacy violations. Our investigation delves into the questionable practices surrounding the Mr.Cash application, a lending platform promoted through the Facebook group “Cash PH Loan,” boasting over 6.8K active members.

Read the Entire Case Studies: Link

The Alternate Routes to Reach People

In response to mounting complaints from countries such as India and the Philippines, Google Play Store and Apple App Store have taken significant steps to address concerns related to predatory lending practices by removing a substantial number of Chinese loan applications from their platforms. Despite these efforts, a concerning number of such applications persist, perpetuating exploitative practices that have drawn widespread criticism.

Read about all the methods used to deploy the apps in the complete report: Link

Countries Case Studies

Dark Side of the Chinese Loan Applications: Phillippines

The Chinese loan app scams in the Philippines are a form of online fraud that targets vulnerable borrowers who need quick cash. These scams involve unlicensed and unregulated lending apps that offer high-interest loans with short repayment periods. The borrowers are required to give access to their contacts, cameras, and social media accounts as part of the loan terms and conditions. If they fail to pay on time, the lenders harass and threaten them and their contacts with abusive messages, calls, and even blackmail. Some of the victims are also tricked into downloading more apps that increase their debts.

From January to November 2023, our investigation unveiled the amassing of more than 12 Million pesos. This money was funneled into the accounts of cybercriminals utilizing over 90 malicious Android apps to dupe their targets.

The Philippine authorities have been cracking down on these illegal lending apps and their operators. In February 2022, the Philippine National Police – Anti-Cybercrime Group (PNP-ACG) arrested 46 suspects, including a Chinese national, who were behind several lending apps that scammed thousands of Filipinos. The suspects were charged with violation of the Cybercrime Prevention Act of 2012.

The Securities and Exchange Commission (SEC) also banned 19 lending apps that were operating without a certificate of authority or license in the Philippines. The SEC warned the public to be cautious and to take measures before engaging in online transactions to avoid being victims of online fraud.

Individuals in urgent need of cash often find themselves falling victim to the deceptive practices associated with the “120-day” loan term. The repercussions of this are felt as early as the 7th day, with relentless text messages and calls from debt collectors.

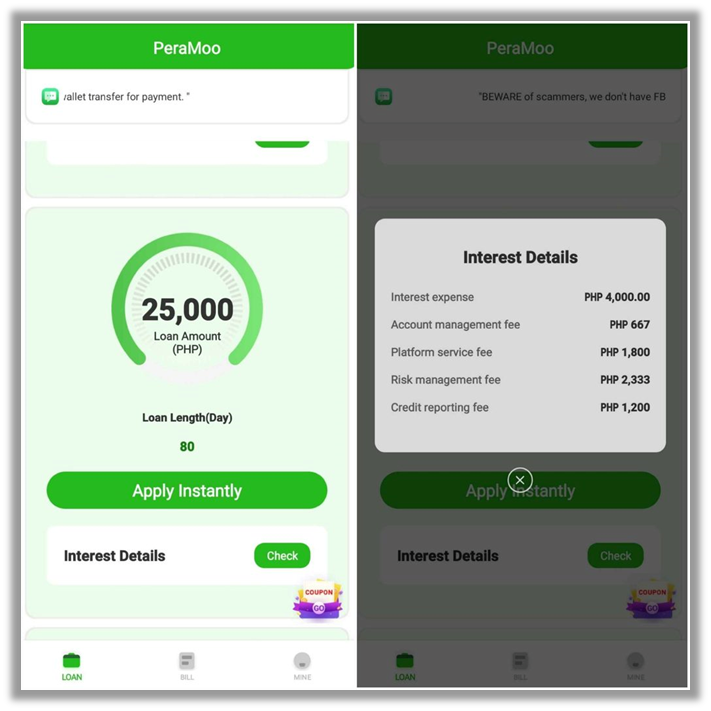

Moreover, the disbursed amounts from these platforms often deviate significantly from the advertised figures. For instance, PeraMoo promotes a loan amount of P25,000, but a closer look reveals that P10,000 is allocated to interest and additional fees. Consequently, the actual disbursed amount is only P15,000. This translates to a staggering 40% in interest and charges that victims are compelled to pay.

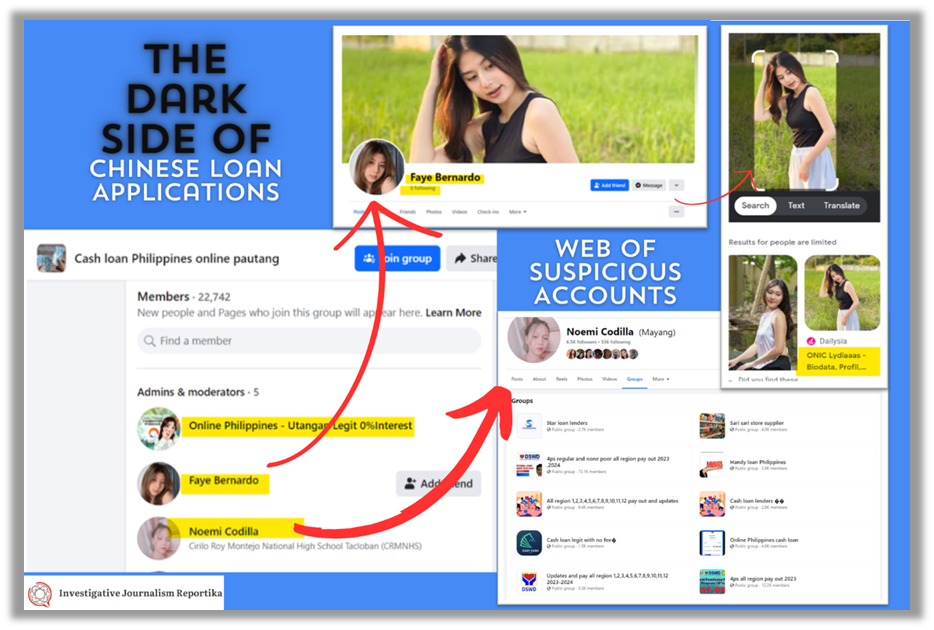

Numerous social media groups and pages in the Philippines, as seen in the image, are implicated in deceptive loan scams, preying on individuals seeking short-term loans. Despite appearing helpful, these platforms often involve fake managing accounts, leading to fraudulent activities.

IJ-Reportika Survey : Philippines

In our recent extensive survey conducted by IJ-Reportika in the Philippines, involving a substantial sample size of 100,000 individuals (age group 25-40 years), we uncovered significant trends related to the usage of Chinese loan applications. The study spanned four major cities, namely Manila, Quezon City, Cebu City, and Davao City.

Read about the Entire Survey in the Complete Report: Link

Dark Side of the Chinese Loan Applications: India

The rising influence of Chinese entities in India poses a multifaceted threat, with two prominent facets garnering significant attention. First and foremost is the surge in Chinese lending apps within India, specifically targeting low-middle-wage citizens.

In 2023, our investigation unveiled the amassing of more than INR 14.3 million. This money was funneled into the accounts of cybercriminals utilizing over 70 malicious Android apps to dupe their targets. Our examination exposed more than 22 covert payment gateways managed by Chinese individuals. These adjustments represent a reaction to heightened legal scrutiny as cybercriminals aim to avoid detection.

In our investigation, we engaged with an Indian Chinese Loan Application User, referred to as Nisha for her safety. Nisha chillingly recounted,

“The loan managers escalated from threats and verbal abuse to using advanced AI to morph my images sourced from social media. They blackmailed me with the threat of leaking these morphed nude/semi-nude pictures.”

Nisha (Victim of Chinese Lending Application)

Nisha, summoning courage, eventually confided in her parents and filed a police complaint. These shocking incidents, far from isolated, have pushed numerous individuals to such depths of despair that some tragically opted to end their lives. The documented cases we encountered through Indian media portray a heart-wrenching tableau of this merciless exploitation.

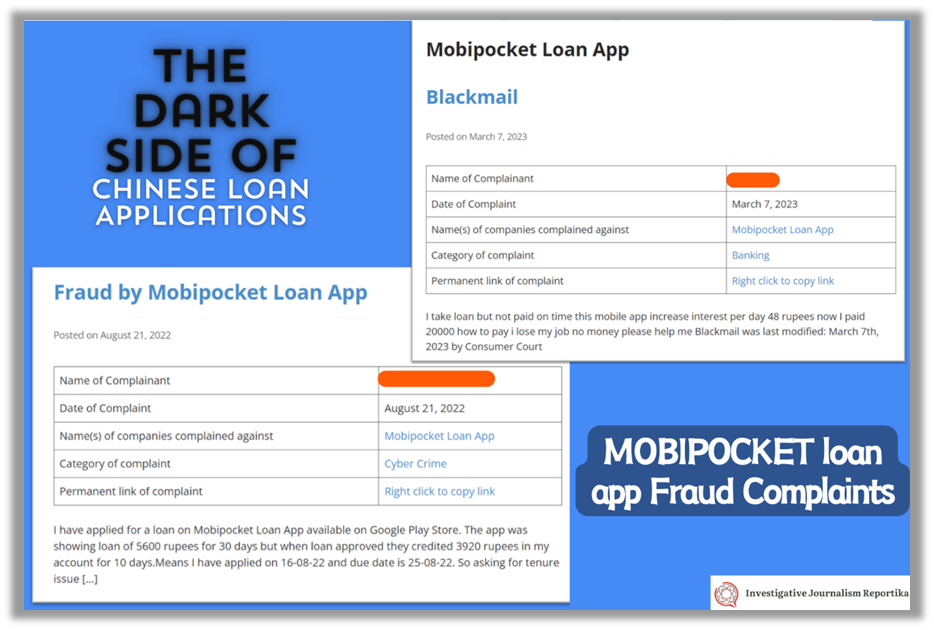

Multiple cases have been filed in the Consumer Court of India against the Mobipocket application for allegations of blackmail and fraud. Our investigation uncovered several other similar applications engaging in illicit activities, including Raise Cash, Cash Ray, Infinity Cash, Kredit Mango, CB Loan, Cash Tree, Minute Cash, Cash Light, HDB Loan, SnapItLoan, and Go Cash. Despite the Indian Government’s ban on many of these applications, they persist in some form on the internet through platforms like Softonic and apkcombo.

IJ-Reportika Survey : India

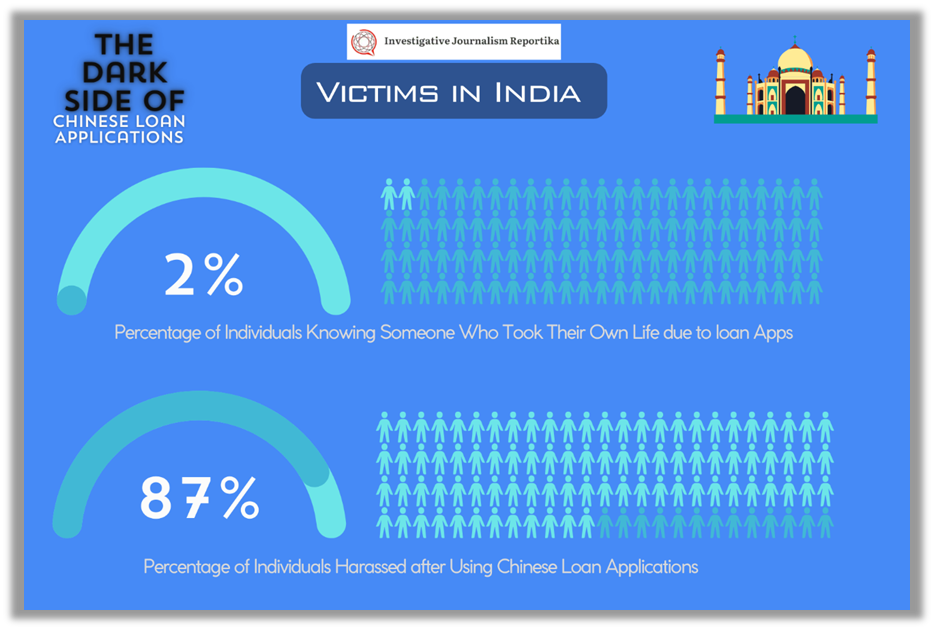

Our recent comprehensive survey conducted in India reached a significant sample size of 100,000 individuals (age group 25-40 years) through a combination of online and offline modes in major cities, including Delhi, Mumbai, Kolkata, Chennai, and Ahmedabad, the findings underscore the challenges associated with Chinese loan applications.

Read about the Entire Survey in the Complete Report: Link

Dark Side of the Chinese Loan Applications: Pakistan

In Pakistan, a surge in rogue lending apps is wreaking havoc on unsuspecting consumers. The Ij-Reportika has unmasked over 93 online lending applications as scams, engaging in predatory lending practices that involve blackmail, harassment, and blatant violations of borrowers’ data privacy. Our investigation has revealed the involvement of both domestic and Chinese companies in this digital loan racket, with names like Flexi Money, Hazir Loan, Credist, Fori Money, Fast Cash, Mr Loan, V Cash, and Mera Rupee were seemingly dubious applications. A host of these applications are available on the internet with a developer named LE THUY DUNG in Pakistan.

Read the Complete Report with details of all related scams: Link

Against the backdrop of Islamabad’s severe macroeconomic crisis, marked by a challenging economic environment, a distressed labor market, reduced remittances, surging prices, and the aftermath of natural disasters, household incomes are plummeting, pushing poverty rates to an alarming 37.2%. Moody’s warns that a substantial chunk of revenue dedicated to interest payments is placing a strain on Pakistan’s ability to manage its debt while meeting essential social spending needs. In this increasingly dire economic landscape, fraudulent app-based loan schemes find fertile ground to exploit vulnerable individuals in Pakistan.

Following is a sample of the suspicious loan applications running in Pakistan.

| 360 Online Qarz | Get It Now | Pyoor Pack |

| 567 Speed Loan | Get Welfare | Qarza Pocket |

| 99 Fast Cash Loan | HamdardLoan | QuickCash |

| Aasan Lab | Harsha Tube | Rico Box |

| Apple Qist Qarz | Hayar Pocket Easy Fund | Rose Cash |

| Asaan Qarza- credit loans | JaidiCredit | Sallam Loan |

| Bee Cash | LendHome | Superb Loans |

| BG Loan | Little Cash | Swift Loans |

| CashCredit-Online Loan | LoanClub | Tazza Center |

| CashPro | MiniLoan | TiCash |

| CreditLoan | Money bee | UrCash |

| CredStar | MoneyBox | Whale |

| Debit Campsite | MrLoan | YoCash |

| DiDi Loans | MY Cash | Zenn Park |

| Easy Cash Loans | MyCash | ZetaLoan |

| Easy Loans | Naqad Qarza-ABC | Money Club |

| Easy Mobile Loans | Plati Loans | Super Magic |

| Fair Loans | Private Credit | Easy Pocket |

| Fast Loan | Galaxy Loan | Monii Pro |

| Fast Manne Loan | OK wallet | Holiday Loan |

| FinMore | ColeCash | Credit Now |

| Fori Instant Loans | Focus loan | EasyLoan Lite |

| Fori Qarz | Wcash Loan | Haath Pocket |

| Pakkicash | LuckMoney | Candycash |

| Pakket Pocket |

IJ-Reportika Survey: Pakistan

In our recent extensive survey conducted in Pakistan, encompassing a sample size of 50,000 individuals (age group 25-40 years), we observed noteworthy trends related to the usage of Chinese loan applications. The study covered major cities, including Karachi, Lahore, Islamabad, and Peshawar.

Within this demographic, in 2023, as many as 170 individuals acknowledged using Chinese loan applications, exposing a concerning reality. Out of these users, a substantial 89.41% reported instances of harassment after their interaction with these platforms. Furthermore, 2.9% of respondents disclosed that they knew someone within this demographic who had tragically taken their own life, attributing the distressing event to the pressures associated with Chinese loan applications.

Complicating matters further, concerns were raised about the lack of assistance from local police and central authorities, with fears that their pleas were either ignored or overlooked. Disturbingly, it was suggested that suicide cases related to these applications might be significantly underreported due to the sensitive nature of the situation involving Chinese applications, potentially posing diplomatic challenges between the two countries.

Dark Side of the Chinese Loan Applications: Africa

Chinese loan app scams in African countries, as extensively discussed in this report, mirror patterns seen globally. Unregulated lenders offer small, high-interest loans, pressuring borrowers to provide personal information as collateral.

Some of the loan apps that have been involved in these scams are:

Read about all the lending applications operating in African countries: Link

IJ-Reportika Survey: Africa

In our extensive survey conducted across Nigeria, Kenya, and Ghana—specifically in cities such as Lagos and Abuja (Nigeria), Nairobi and Mombasa (Kenya), and Accra and Kumasi (Ghana)—we gathered data from a sample size of 200,000 individuals (age group 25 to 40), shedding light on the pervasive use of Chinese loan applications in the African context.

Within this demographic, a whopping 3,650 individuals admitted to using Chinese loan applications, a significant revelation considering the associated challenges. Among these users, a substantial 93.4% (3,412 individuals) reported instances of harassment following their interaction with these platforms. Furthermore, 1.56% of respondents (57 individuals) disclosed that they personally knew someone within this demographic who had tragically taken their own life, attributing the distressing event to the pressures associated with Chinese loan applications.

Compounding the issue, regulatory steps taken by Nigeria and Kenya were deemed inadequate, and in Ghana, despite government officials pointing out the shortcomings, backdoors like TikTok and Facebook groups remain available to dupe people with these applications. Most individuals in the sample belonged to the lower and lower-middle-class segments, seeking funds to start small businesses and sustain their families.

A notable contrast emerges in the Chinese agents’ behavior, openly displaying their identities in African countries, unlike in other nations where they remain hidden. Governments in Nigeria, Kenya, and Ghana, according to our investigation with government officials, seem to downplay suicide and harassment cases to preserve diplomatic relations with China, due to their considerable debt burden from Belt and Road Initiative (BRI) projects.

Our prior reports extensively investigated the status of stalled Belt and Road Initiative (BRI) projects and drew attention to the presence of Chinese fishing ships in the Exclusive Economic Zones (EEZ) of several African countries. These findings suggested a prevailing trend of governments of most African countries overlooking critical issues to preserve diplomatic relations. Our investigation, involving discussions with government officials, confirmed this trend and indicated that such actions are influenced by the significant debt burden resulting from BRI projects.

Protective Measures Against Chinese Loan App Scams

To safeguard against Chinese loan app scams, individuals are advised to take the following preventive actions:

1. Verify Lender Legitimacy:

- Do not use unlicensed and untrustworthy online lending services.

- Always check the legal status and reputation of lenders before applying for loans.

2. Protect Personal Information:

- Avoid giving access to personal information, including ID cards, bank accounts, phone numbers, and social media accounts, to any online lenders.

- This information can be exploited for scams and harassment targeting you and your contacts.

3. Exercise Caution with Apps:

- Do not download any apps recommended or required by online lenders.

- Such apps may increase your debts or compromise your data security.

4. Report Suspicious Activities:

- Report any suspicious or fraudulent activities to the authorities.

- If scammed or harassed by online lenders, promptly contact the police and relevant agencies to file a complaint and seek assistance.

These individual-level precautions, when coupled with international collaboration and government efforts, contribute to creating a safer online lending environment for everyone.

References

- https://consumercomplaintscourt.com/rupayekey-jimmy-anggrean-fraud/

- https://sundayguardianlive.com/news/chinese-loan-apps-pose-threat-india

- https://apkcombo.com/rupayekey/com.app.rupayekey/

- In India, some of the apps that have been involved in these scams are CashBean, Okash, Opesa, Zenka, Palmcredit, Branch, and Carbon.

- In Kenya, some of the apps that have been involved in these scams are CashBean, Okash, Opesa, Zenka, MTN Qwikloan, and Lime.

- In Myanmar, some of the apps that have been involved in these scams are RupeeGo, Rupee Here, LoanU, QuickRupee, Punch Money, Grand Loan, DreamLoan, CashMO, Rupee MO, CreditLoan, Lendkar, RockOn, HopeLoan, Lend Now, and Cashfull.

- In February 2022, the Philippine National Police – Anti-Cybercrime Group (PNP-ACG) arrested 46 suspects, including a Chinese national, who were allegedly behind several lending apps that scammed thousands of Filipinos

- The suspects were charged with violation of the Cybercrime Prevention Act of 2012

- The SEC warned the public to be cautious and to take measures before engaging in online transactions to avoid being victims of online fraud

- The Securities and Exchange Commission (SEC) also banned 19 lending apps that were operating without a certificate of authority or license in the Philippines

- In November 2023, the Detective Branch (DB) of Police arrested 15 people including a Chinese national for operating loan scams through social media

- The suspects were charged with violating the laws on credit institutions, cyber security, and telecommunications

- https://techwireasia.com/12/2023/how-do-new-malicious-fake-loan-apps-work/

- The African governments and regulators have been taking measures to stop these illegal lending apps and their operators, as well as to protect the rights and interests of the borrowers